Just as Uniswap allowed any tokens to be tradable, Particle will allow any tokens to be tradable with leverage.

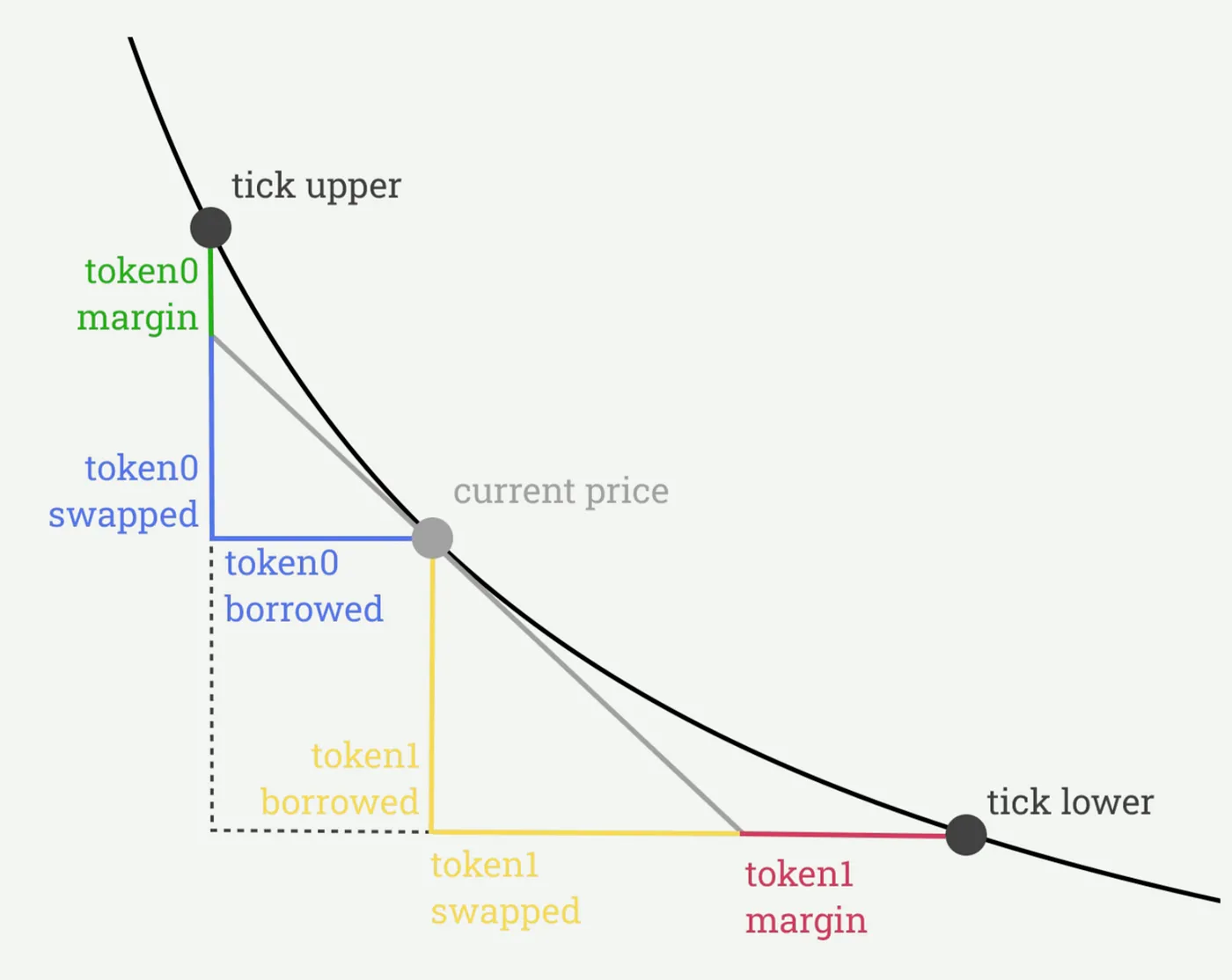

Taking a first-principle approach, any form of leverage involves borrowing an amount of asset that has a higher value than the original investment. To leverage the vast amount of DeFi liquidity, Particle protocol enables traders to directly borrow from liquidity pools at automated market makers (AMMs) with concentrated liquidity (Uniswap v3 as a start).

This is the foundation of Particle’s Leverage AMM (LAMM).

Permissionless and Scalable With this design, Particle protocol eliminates the need for a price oracle — eliminating a number of potential attack vectors and the potential for market manipulation. For most traditional perpetual futures platforms, the counterparty of traders (e.g. taking long positions) are traders on the other side (e.g. taking short positions). These platforms require sophisticated mechanisms to manage counterparty risks by balancing the incentives on the two sides (e.g. with dynamic funding rates). On Particle, the leverage comes from the relative value increase/decrease of the underlying assets. This means that the Profit and Loss (PnL) is determined by the performance of the asset itself, as opposed to a counterparty’s loss. The scalability of the Particle protocol means that with enough available liquidity, the protocol can efficiently support a wide range of trading positions — whether it’s managing a single long position, accommodating a massive number of 10,000 unbalanced long positions, or balancing a combination of 5,000 long and 5,000 short positions. Particle can handle these positions seamlessly at scale.

To learn more about Particle, request alpha access here.